Reason 4: Employer Match means More Savings

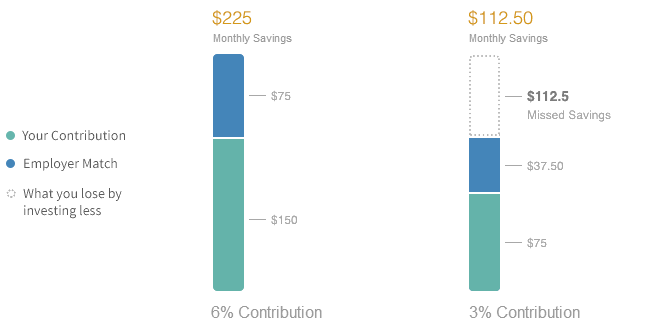

Your employer may match a percentage of the salary you contribute to the plan and that means more savings for you!

Annual Pay: $30,000 Employer Match: 50% up to 6% of salary contributed to the plan

Close

Disclaimer

For illustrative purposes only. Illustration assumes a $30,000 annual salary, pre-tax contributions, and a company match of 50% up to the first 6% of salary contributed in the plan. There may be requirements to make elective deferrals and/or get your company match, see your Summary Plan Description for details. There may be limits under the plan and/or Internal Revenue Code on the amount of elective deferrals you can make to the plan and the amount of match you can receive.

Disclaimer

By clicking the Continue button below, you confirm

that you have read the Disclaimer button.

By clicking the Continue button below, you confirm

that you have read the Disclaimer button.